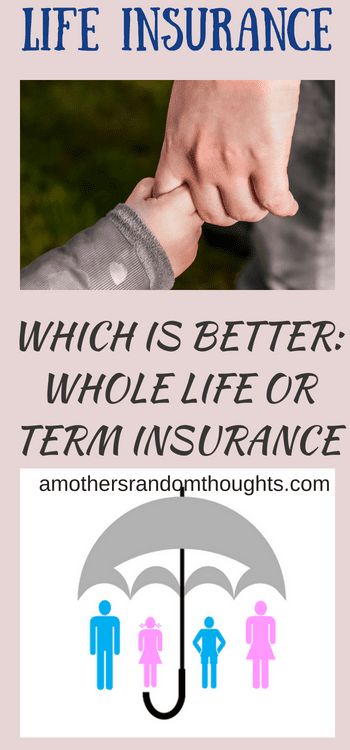

WHICH IS BETTER: WHOLE LIFE OR TERM INSURANCE? AND WHY DOES IT MATTER?

You love your family. And you want to make the best possible choices. What would happen if you were gone tomorrow? What about next year? Insurance can be confusing. Whole Life Insurance, Term Insurance – what do these words mean? Which is better? Why should you buy insurance? Are you just confused and looking for answers? Are you concerned about buying insurance and finding out you made a bad choice when it is too late to change? Today I will answer the question: Which is better: whole life or term insurance?

The reason this is an important area for me is because years ago my husband and I made some mistakes regarding life insurance. These expensive mistakes are now causing an added financial burden to our family that could have been avoided. You can read about it here.

So which is better: Whole Life or Term Insurance?

With both whole life and term insurance, the younger and healthier you are, the less your premiums will cost. The longer you wait to purchase insurance, the more it will cost you overall.

Whole Life Insurance versus Term Insurance Explained:

WHOLE LIFE INSURANCE

This insurance is insurance that does not “expire.” As long as you keep paying the required premium for the length of time set forth in the policy the insurance remains in force. Most of the time, the premiums are higher than term insurance policies, but the premiums do not increase as you age.

It has cash value that grows over time, almost like a savings or investment account. You may be able to take the cash value out of the policy or borrow money against the policy. As the policy starts to accumulate cash value, your premium may be reduced. The death benefit (face value of the policy) pays your beneficiary when you die. This pays out the full amount whether you die 5 days after the policy is issued or 40+ years later as long as you adhere to the terms of the policy.

PROS:

- Premium does not go up as you age

- Policy cannot be cancelled

- Death benefit is stated face amount, but may be higher if cash value has accumulated

- The younger you are when you get the policy, the lower your yearly premiums will be

- If you cancel your whole life policy, you will receive any cash value that has accumulated

CONS:

- If you get the policy when you are young, you may end up paying for many, many years, but all of this is stated in the initial policy.

- Is more complex than term life insurance

- Premiums are higher than a term life insurance policy

TERM LIFE INSURANCE:

Term Life insurance is insurance that does “expire” when the term is up. If you purchase a 10-year term policy, at the end of 10 years you need to purchase another term and the premiums will be higher at that point.

Premiums of term life are lower than whole life insurance policies. Term insurance does not accumulate cash value. If you stop paying, the insurance expires, and your policy is worth nothing. You cannot borrow against your policy. The death benefit (face value of the policy) pays your beneficiary only if you die within the term.

PROS:

- The premium will be lower than a similar policy of whole life.

- May be an excellent choice if you want to purchase insurance to pay off your mortgage or another large expense in the event you die before the expense is paid off.

- Term life insurance is cheaper than mortgage insurance through your lender.

CONS:

- Think of this insurance as temporary.

- If you stop paying, your policy is worth nothing.

- When the term is over, it may be costly to purchase another term.

- If you have an illness or injury, you may not be able to purchase another term policy

- Often these policies are sold by a financial adviser who tells you that you just need this policy until you get your finances in order. Many people purchase term because they believe they will no longer need the life insurance when they sell their business or save a certain amount of money, but this plan does not take into account rainy days and plans that don’t work out.

Questions to ask yourself: Do you want to provide an inheritance for your children? Do you know if your children will be taken care of in the event that you die before they are raised? Will any of your children need long-term care after you are gone?

Some of these questions cannot be answered until it is too late to get insurance. But my answer and recommendation to the big question – Which is better: Whole Life or Term Insurance? Protect your loved ones now by getting Whole Life Insurance now!

To talk with an insurance agent in Ohio or Pennsylvania, contact David Moliterno at 234-254-5660 or visit him at Moliterno Insurance.

IF YOU WOULD LIKE TO ASK ME MORE QUESTIONS, FEEL FREE TO CONTACT ME AT [email protected]

Reviewing movies for parents from a Christian perspective since 2005. Know Before You Go!

Christian Homeschooling mom – 30 years and counting

Autism Mom & Disney enthusiast