This post contains affiliate links. As an Amazon Affiliate, I do earn from qualifying purchases.

Do you know what you want to be when you grow up? That is the question that children and teens are often asked. My 17-year-old son doesn’t know and it frustrates him. Marcus is a great kid with lots of talent, but really is not sure of his future! I decided we are going to give him lots of experiences and courses that are not traditionally done in high school. When I was asked to review Personal Finance Illustrated® Homeschool Edition by Pem Life, I thought this would be the perfect opportunity for 1) teaching personal finance, and 2) see if financial planning was the direction for Marcus.

I already have one older son in the financial industry, and Marcus has learned some things from his older brother. Find out if this course helped Marcus make some life decisions.

What is Pem Life?

Does thinking about money give you a headache? Saving, buying, spending, mortgages, taxes, and more tend to stress people out. If you are not comfortable with money, how are your children going to learn?

Personal Finance Illustrated® Homeschool Edition by Pem Life is a single semester money management course for older students. This personal finance course is online, and with the purchase, you have access for a 6 month period.

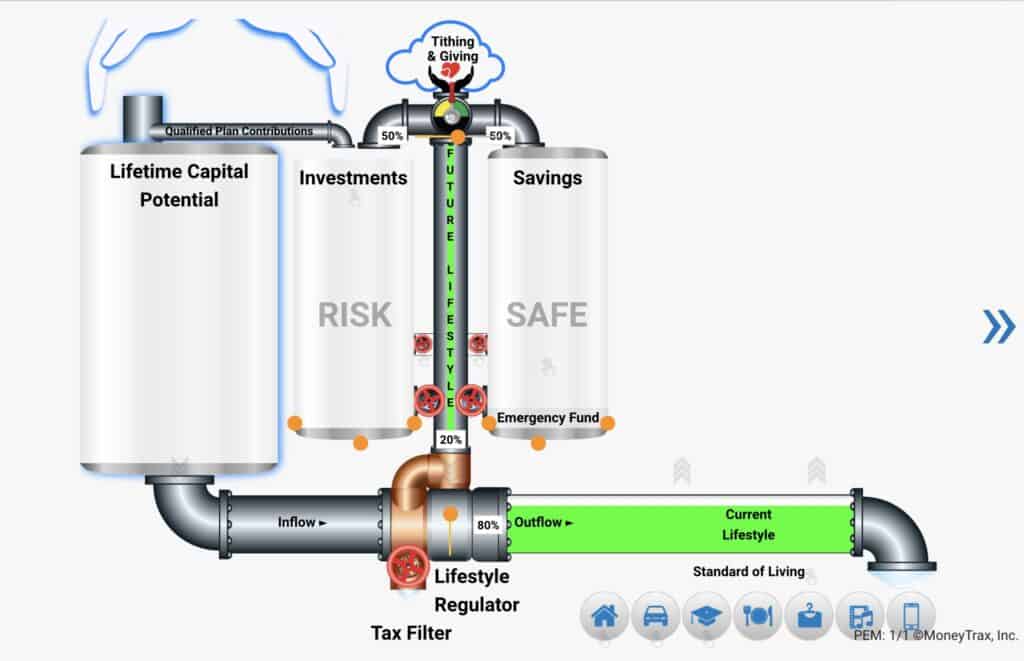

The Personal Economic Model® is the foundation for the lessons in the Personal Finance Illustrated® Homeschool Edition course. This model was developed for the financial advisory community.

PEM LIFE teaches your student the financial concepts that are essential to managing their money.

What is Included in Personal Finance Illustrated® Homeschool Edition?

After you sign up with Pem Life, you have two options.

The Proctored Path: This is the equivalent of a 3 credit-hour collegiate level course with all lectures, quizzes, and assignments included. Your child goes through the content on their own and watches video lessons and completes the daily assignments. As a parent, you can oversee their progress.

The Instructional Path: An Instructor Guide is built into each Unit. This guide contains lesson plans, instructor coaching videos, and more designed to help you teach your child.

Additionally, you can do a combination of both methods. Obviously, your child will receive maximum benefit by working through the curriculum with a parent.

Additionally, if you enroll a second student, there is a discount for student number 2. Each student will have their own dashboard and can work through the course at different paces.

How Our Family Used Pem Life?

Marcus used a combination of the Proctored Path and the Instructional Path. As I work and have a child with special needs, I am not always available to “instruct.” However, I was able to work through some of the lessons with Marcus.

While teaching personal finance was something I have done all of his life, I have never taught an organized course. Marcus is taking this course a little slower than laid out. Instead of a semester, this will be a 6-month course in our household.

Additional Thoughts on Pem Life

The following is taken from the Course Syllabus:

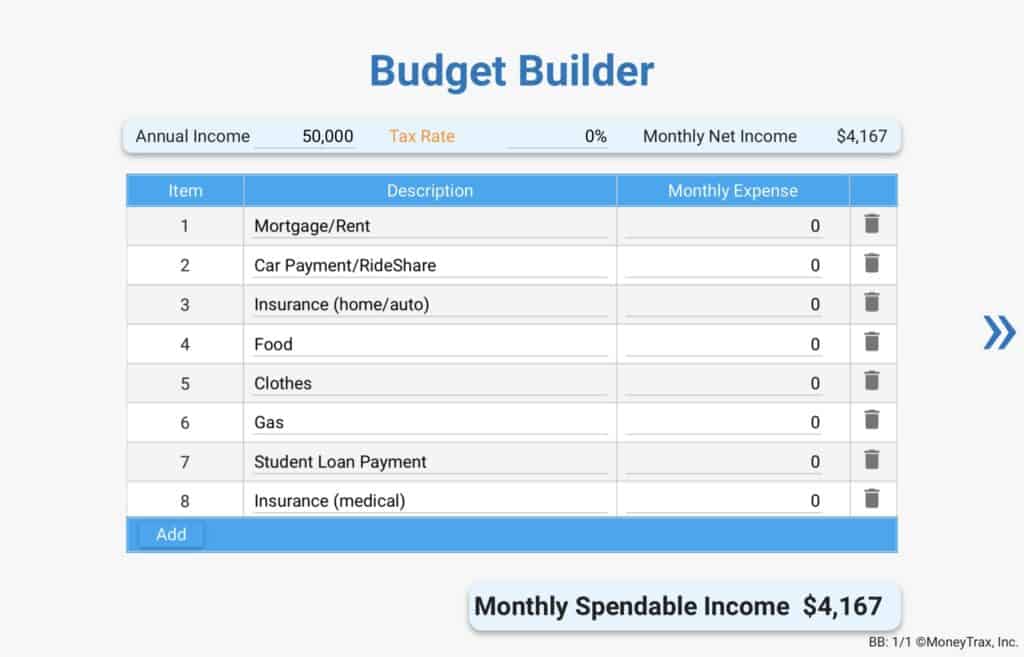

Course Description: A study of personal wealth management from a Christian worldview. Topics covered include personal budgeting, financial planning, tithing, taxes, insurance, investments, giving, managing credit, and retirement planning.

Course Objectives:

At the completion of the course students should:

Define the personal financial planning process

Describe financial terms

Identify their current and future financial plans

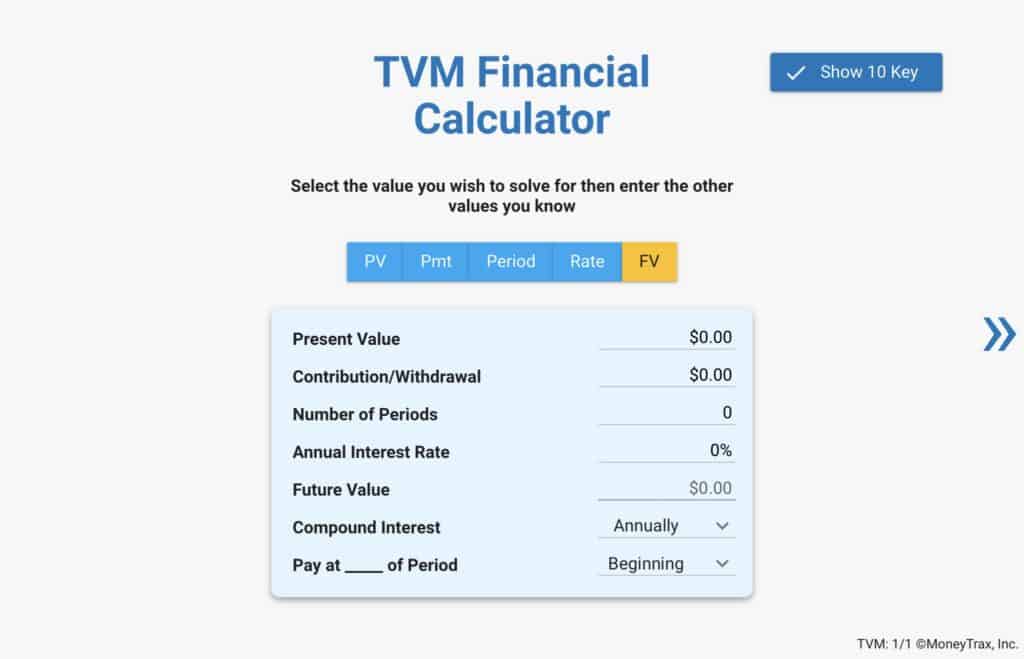

Articulate their financial goals recognizing interest earned on investments using TVM.

Employ financial tools that can be consulted when making financial decisions.

Produce a personal financial model based on biblical & investing principles.

At times, Marcus was frustrated at the pace of the course. There are 18 Units in the course. Knowing that we have 6 months access, I slowed the pace down because there is a lot of work. (This is a college level class, and Marcus is already doing 2 other college level classes).

While Marcus is enjoying learning the information in the course, I am not sure finance is the direction for him. Some of the things I noticed was that he was becoming more anxious about money than before the course.

My Final Recommendations:

First, Personal Finance Illustrated® Homeschool Edition is an extremely thorough course in Personal Finance. Be aware that this course is not just a budgeting course, but rather an in-depth financial course designed to teach all aspects of personal finance.

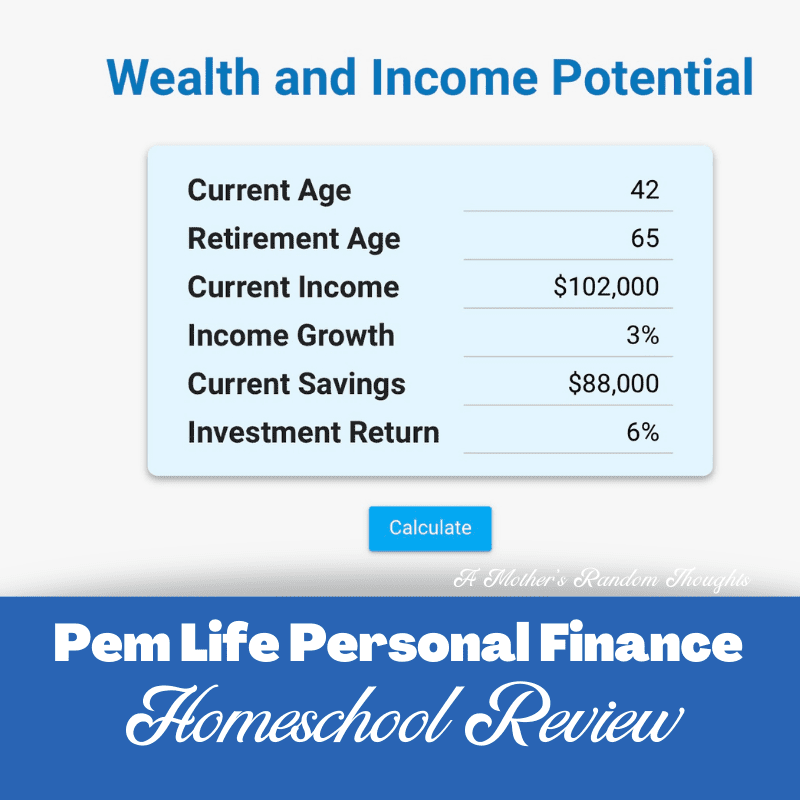

Next, the calculators and financial tools are great. The Personal Economic Model, the Budget Builder, The TVM Financial Calculator are wonderful resources to help you or your child gain a greater understanding of how we can make our finances work for us.

Finally, I personally know I would have benefited from this course when I was much younger and some of these lessons took me way too long to learn. I truly believe that the earlier our children learn them the better off they will be.

Read thoughts on Pem Life from other Homeschool Review Crew Members.

Reviewing movies for parents from a Christian perspective since 2005. Know Before You Go!

Christian Homeschooling mom – 30 years and counting

Autism Mom & Disney enthusiast